alameda county property tax calculator

We accept Visa MasterCard Discover and American Express. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median.

Alameda County Property Tax Tax Collector And Assessor In Alameda

Alameda County collects on average 068 of a propertys assessed fair market value as property tax.

. Dear Alameda County Residents. Best Free Tax Software. Credit Karma Tax Review.

Many vessel owners will see an increase in their 2022 property tax valuations. Many vessel owners will see an increase in their 2022 property tax valuations. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel.

No fee for an electronic check from your checking or savings account. Search Valuable Data On A Property. Ad Find Alameda County Online Property Tax Bill Info From 2022.

Dear Alameda County Residents. Dear Alameda County Residents. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Los Angeles.

A convenience fee of 25 will be charged for a credit card transaction. The State Board of. In our calculator we take your home value and multiply that by your countys effective property tax rate.

The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. Dear Alameda County Residents. For comparison the median home value in Los Angeles County is 50880000.

This is equal to the median property tax paid as a percentage of the median home value in your county. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. Any real estate owner can question a real property tax assessment.

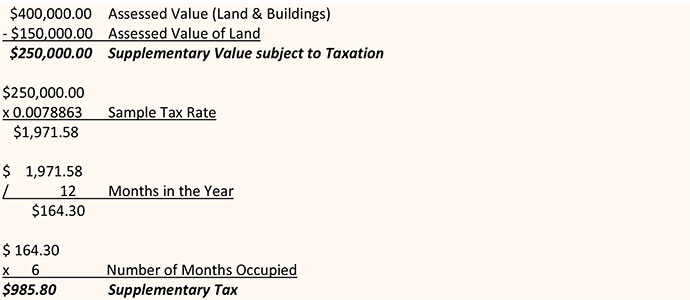

If you have atypical situations or have additional questions about supplemental assessments please call the Assessors Office at 510 272-3787. Prior to doing so consider what the valuation actually does to your annual tax payment. Find your real property tax bill incorporating any exemptions that pertain.

This map shows property tax in correlation with square footage of the property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Start Your Homeowner Search Today.

The State Board of Equalization reviews average. Click on the map to expand. The system may be temporarily unavailable due to system maintenance and nightly processing.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. Such As Deeds Liens Property Tax More. The system may be temporarily unavailable due to system maintenance and nightly processing.

Many vessel owners will see an increase in their 2022 property tax valuations. If you have to go to court you may need service of one of the best property tax attorneys in Alameda County CA. Alameda County Sales Tax Rates for 2022.

You can find more tax rates and allowances for Alameda County and California in the 2022 California Tax Tables. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value. Many vessel owners will see an increase in their 2022 property tax valuations.

The State Board of Equalization reviews average. How to Fill Out W-4. Alameda County in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Alameda County totaling 175.

Pay Your Property Taxes Online. You can pay online by credit card or by electronic check from your checking or savings account. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Alameda County Tax.

For comparison the median home value in Alameda County is 59090000. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. Find Information On Any Alameda County Property.

Lookup or pay delinquent prior year taxes for or earlier. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Ad Get In-Depth Property Tax Data In Minutes. The State Board of Equalization reviews average. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Alameda County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. To use the Supplemental Tax Estimator please follow these instructions. Lookup or pay delinquent prior year taxes for or earlier.

Enter the purchase date in mmddyyyy format eg 05152007.

City Of Oakland Check Your Property Tax Special Assessment

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Bidding Wars And Meaningless List Prices Buying A House In The Bay Area

Business Property Tax In California What You Need To Know

Business Property Tax In California What You Need To Know

Decline In Market Value Alameda County Assessor

Transfer Tax Alameda County California Who Pays What

Pin On Articles On Politics Religion

How Is Supplementary Tax Calculated The City Of Red Deer

Business Property Tax In California What You Need To Know

Business Property Tax In California What You Need To Know

Property Tax California H R Block

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Rental Property Owner Management Kit Rental Owner Printable Etsy Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Search Unsecured Property Taxes

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be